Margin vs Markup

Knowing the difference between margin and markup is crucial to profitability.

To run a business, you have to earn more money than you spend. That’s pretty obvious. But how do you know if you’re pricing each product to earn enough profit? That’s less obvious, but critical to your business success. Let’s get into it.

Fundamental Financial Terms

Every product you make has materials cost and labor cost. You buy components or raw goods, and spend time fabricating or assembling them into a finished product. Those combined costs are the COGS (Cost of Goods Sold).

COGS = Materials + Production Labor

When you sell a product, you charge more than COGS to earn a profit. The difference between the selling price and COGS is called Gross Profit (this differs from Net Profit since Gross Profit doesn’t factor in fixed expenses like rent, utilities, insurance, etc.).

Gross Profit = Sales - COGS

Gross Profit is important because it’s the dollars you have in the checking account after each sale, but it’s not a useful metric to compare profitability of one product to another. For example, earning a Gross Profit of $10 on a product that takes $1 to manufacture is much better than earning $10 on a product that uses $100 in COGS. Both products earn the same Gross Profit, but require very different effort.

To normalize Gross Profit, it’s more helpful to think of it as a percentage so we can compare the earning efficiency of different products with different COGS. Using a percentage of Gross Profit also allows us to compare our overall efficiency to other companies by looking at published metrics in the industry. Gross Margin normalizes Gross Profit as a percentage of sales.

Gross Margin = Gross Profit / Sales

Analyzing your Income Statement, aka Profit and Loss Statement, you can determine a Gross Margin that will achieve a healthy Net Profit (the money remaining after all expenses are paid). Industry averages show that Miscellaneous Manufacturing typically has a 40% Gross Margin, so let’s use 40% to crunch some numbers.

If you sell a product for $100 with a 40% Gross Margin you earn $40 in Gross Profit and spend $60 in COGS for each unit sold.

$100 Sale ⨉ 40% Gross Margin = $40 Gross Profit

$40 Gross Profit = $100 Sale - $60 COGS

Easy peasy.

Deriving a Markup from Gross Margin

The last example was conveniently simple, but backwards from what we normally need to do. Usually we know our COGS and the target Gross Margin, but we need to come up with a price to charge the customer that is profitable. How can we get from COGS to sale price and maintain our desired Gross Margin?

You’ve heard the term Markup — a simple multiplier that you apply to a cost to get a selling price. Sounds perfect! But what Markup should we use? This is where I see confusion creep in.

Let’s go back to our easy numbers. We have a COGS of $60 and we need to make a 40% Gross Margin, sounds like a 40% Markup should work, right?

$60 * 1.4 = $84

Hmph. Something seems weird. This looks like the selling price only needs to be $84? Were we overcharging at $100? Let’s calculate the Gross Margin at $84 just to double-check:

Gross Profit = $84 Sale - $60 COGS = $24 Gross Profit

Gross Margin = $24 / $84 = 29% Gross Margin

What the heck happened? Well… we mixed up our terms here. We wanted a 40% Gross Margin, but we used a 40% Markup to calculate the selling price. Gross Margin and Markup are related, but not the same.

Markup = 1 / ( 1 - Gross Margin )

Markup = 1 / ( 1 - 0.4 )

Markup = 1.67 for 40% Gross Margin

Ok, with that squared away, lets try this again.

$60 COGS * 1.67 Markup = $100 Sale Price

Perfect. Now the math works again. Using the formulas above, you can easily calculate a useful Markup from a desired Gross Margin. And, with a given Markup you can also calculate the resulting Gross Margin.

Gross Margin = 1 - ( 1 / Markup )

confirming with our earlier example

Gross Margin = 1 - ( 1 / 1.67 ) = 40%

Off the Shelf can help

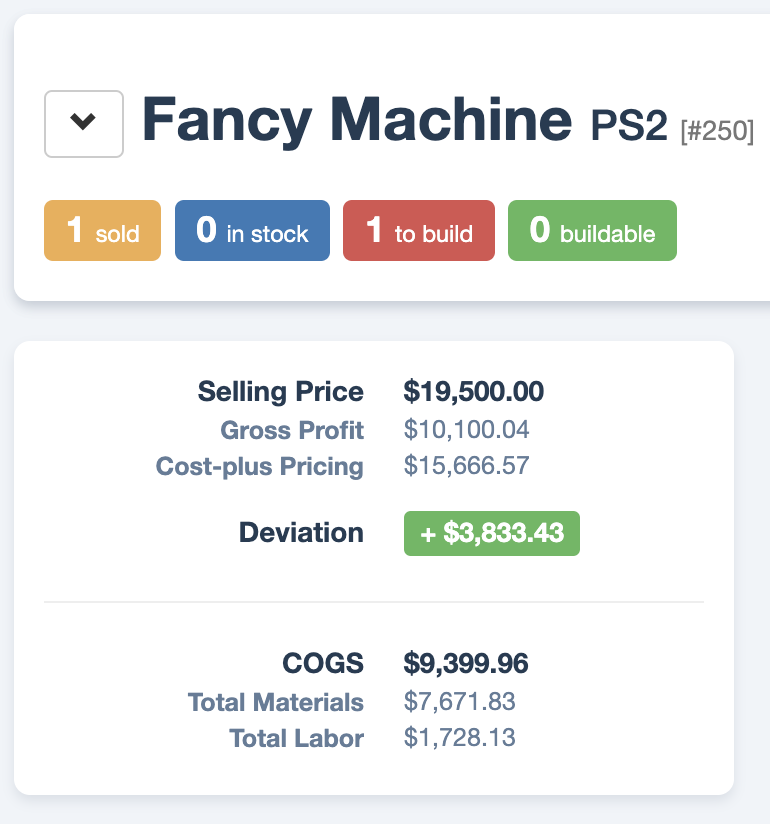

Wouldn’t it be lovely if you didn’t have to constantly convert from Gross Margin to Markup to determine a profitable price for your products? We thought so too, so we built that into Off the Shelf. The Cost-Plus Price shown in Off the Shelf is the sum of COGS + Gross Margin. Off the Shelf automatically calculates the Markup for you based on your pricing parameters.

To configure your pricing parameters, select Pricing Config from your admin profile. Then click Add Pricing. Punch in your desired materials Gross Margin, Labor Cost, and Labor Price. We split out the Materials and Labor because some folks use different profit margins for each.

With your pricing configured, now you can see that Off the Shelf will calculate a recommended price for each product. Whether it’s simple:

Simple product pricing

Or something more intricate with nested subproducts and multiple labor processes:

Complex product pricing

Pro tip: You don’t have to use the Cost-Plus Price. Enter whatever Selling Price you like, but Off the Shelf will show the Cost-Plus Price and the deviation between it and the Selling Price. Green means your charging more than the margin (yay!) and red means your dipping below the margin.

I hope that helps sort out the difference between Gross Margin and Markup. If you’d like to learn more about the pricing features in Off the Shelf, check out this short video:

Psst…if you’re looking for an easy way to calculate profitable prices, check out Off the Shelf!